vermont income tax rate 2021

Vermont School District Codes. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66.

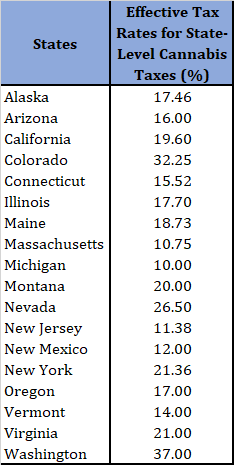

Analysis Potential Commercial Cannabis Demand Sales And Tax Revenue In Vermont Vicente Sederberg Llp

Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

. As you can see your Vermont income is taxed at different rates within the given tax brackets. IN-111 Vermont Income Tax Return. RateSched-2021pdf 3251 KB File Format.

The Internal Revenue Service has released the new tax brackets for 2021 applying to seven different income earners. The 2022 state personal income tax brackets are. Introduction Vermont consistently ranks close to the top of the 50 states in terms of tax burden per capita as shown in 2022 Fiscal Facts published by the Vermont Legislative.

Vermont Income Tax Rate 2020 - 2021. Corporations other than S corporations 25. 2021 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Tax Year 2021 Personal Income Tax - VT Rate Schedules. Personal Property Replacement Tax. Effective July 1 2017.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. A 32 rate applies to singles with income up to 209425. Compare your take home after tax and estimate.

THE TAX SCHEDULES AND RATES. Vermont Tax Brackets for Tax Year 2020. This listing is strictly to confirm receipt of tax rate change documentation.

An approval letter will be sent by Legal Services once the documentation has been reviewed. Individual Income Tax. PA-1 Special Power of Attorney.

W-4VT Employees Withholding Allowance Certificate. Any income over 204000 and 248350 for. 495 percent of net income.

IIT prior year rates. The 2022 state personal income tax brackets. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like.

Tuesday January 25 2022 - 1200. Before the official 2022 Illinois income tax rates are released provisional 2022 tax rates are based on Illinois 2021 income tax brackets.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Vt Dept Of Taxes Vtdepttaxes Twitter

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Vermont Department Of Taxes Facebook

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute

Vermont Department Of Taxes Facebook

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

State Income Tax Rates Highest Lowest 2021 Changes

General Sales Taxes And Gross Receipts Taxes Urban Institute

States With The Highest Lowest Tax Rates

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Sales Tax Rates 2022 Avalara

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation