how does hawaii tax capital gains

Licensing and Tax Information for New Businesses. Long-term gains are those realized in more than one year.

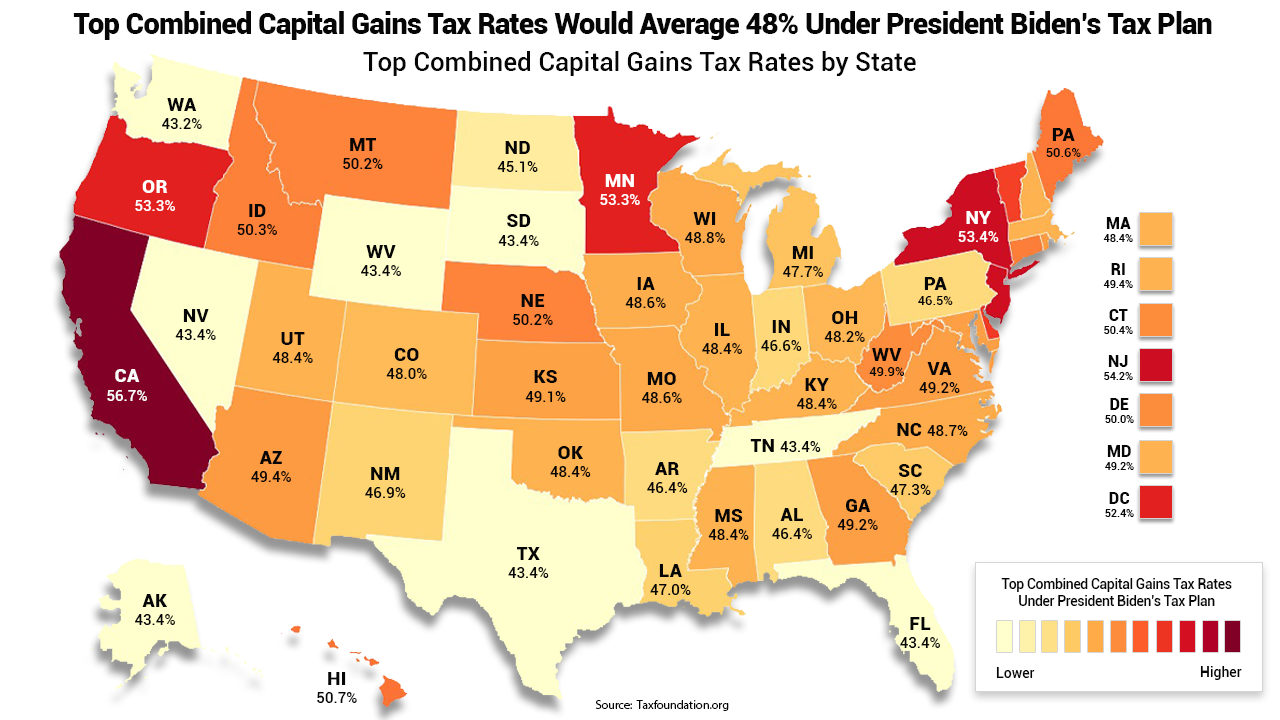

The States With The Highest Capital Gains Tax Rates The Motley Fool

Head of household.

. 5 hours agoAs a baseline in order for your profits interests to qualify for the intended preferential tax treatment never treated as compensation and immediate capital gains opportunity they need to have a day 1 value of 0 meaning that if the company liquidated on the date you received your award you wouldnt receive even a penny in distributions. Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status.

Itemized deductions generally follow federal law. That applies to both long- and short-term capital gains. Taxpayers with federal adjusted gross income over certain thresholds single 100000.

If the appropriate Hawaii income tax return ex. The Hawaii capital gains tax on real estate is 725. Married filing joint 200000.

In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above. The Hawaii capital gains tax on real estate is 725. Hawaiis tax system ranks 41st overall on our.

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. General coverage of federal laws that are relevant to Hawaii income tax or Hawaii estate tax Unreported Tax Court Decisions Tax Audit Guidelines. Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent.

For complete notes and annotations please see the source below. If the collected amount is too large how do you obtain a refund. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

Information on Hawaii State Taxes for Taxpayers Doing Business in Hawaii. Digest of Tax Measures. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017.

Hawaiis capital gains tax rate is 725. Capital Gains Tax in Hawaii. Tax Clearances for State and County Contracts.

Long term capital gains are taxed at a maximum of 725. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs.

Form N-15 for the year is available then the owner should file the appropriate tax return instead of. Hawaii also has a 440 to 640 percent corporate income tax rate. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average combined state and local sales tax rate of 444 percent.

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. The information provided in this publication does not cover every situation and is not intended to.

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Real Estate Or Stocks Which Is A Better Investment

State Corporate Income Tax Rates And Brackets Tax Foundation

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How High Are Capital Gains Taxes In Your State Tax Foundation

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Hawaii Income Tax Calculator Smartasset

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

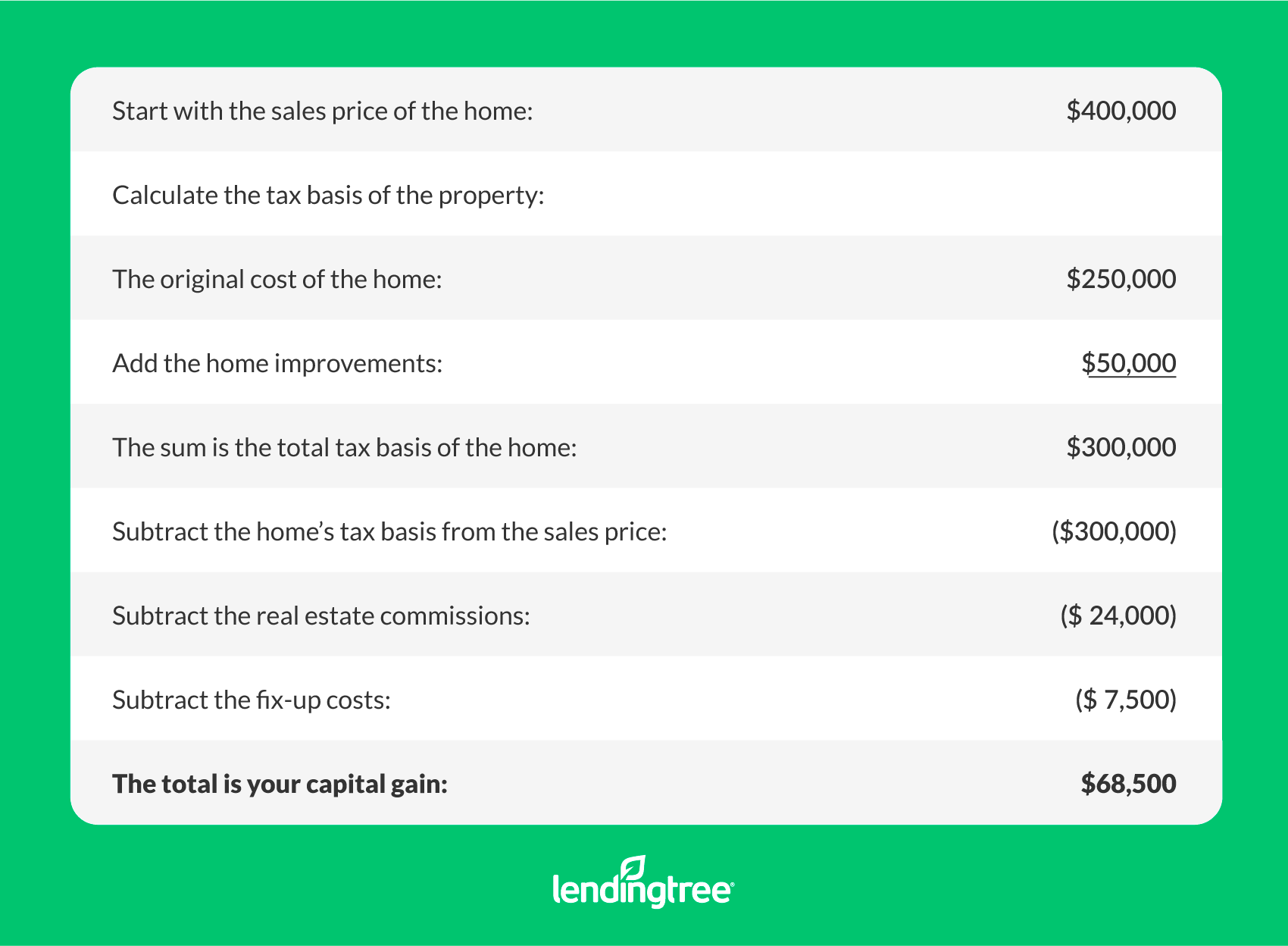

Capital Gains Tax On A Home Sale Lendingtree

A Taxing Story Capital Gains And Losses Hawaii Financial Advisors Inc

Oregon S Capital Gains Tax Is Too High Oregonlive Com

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

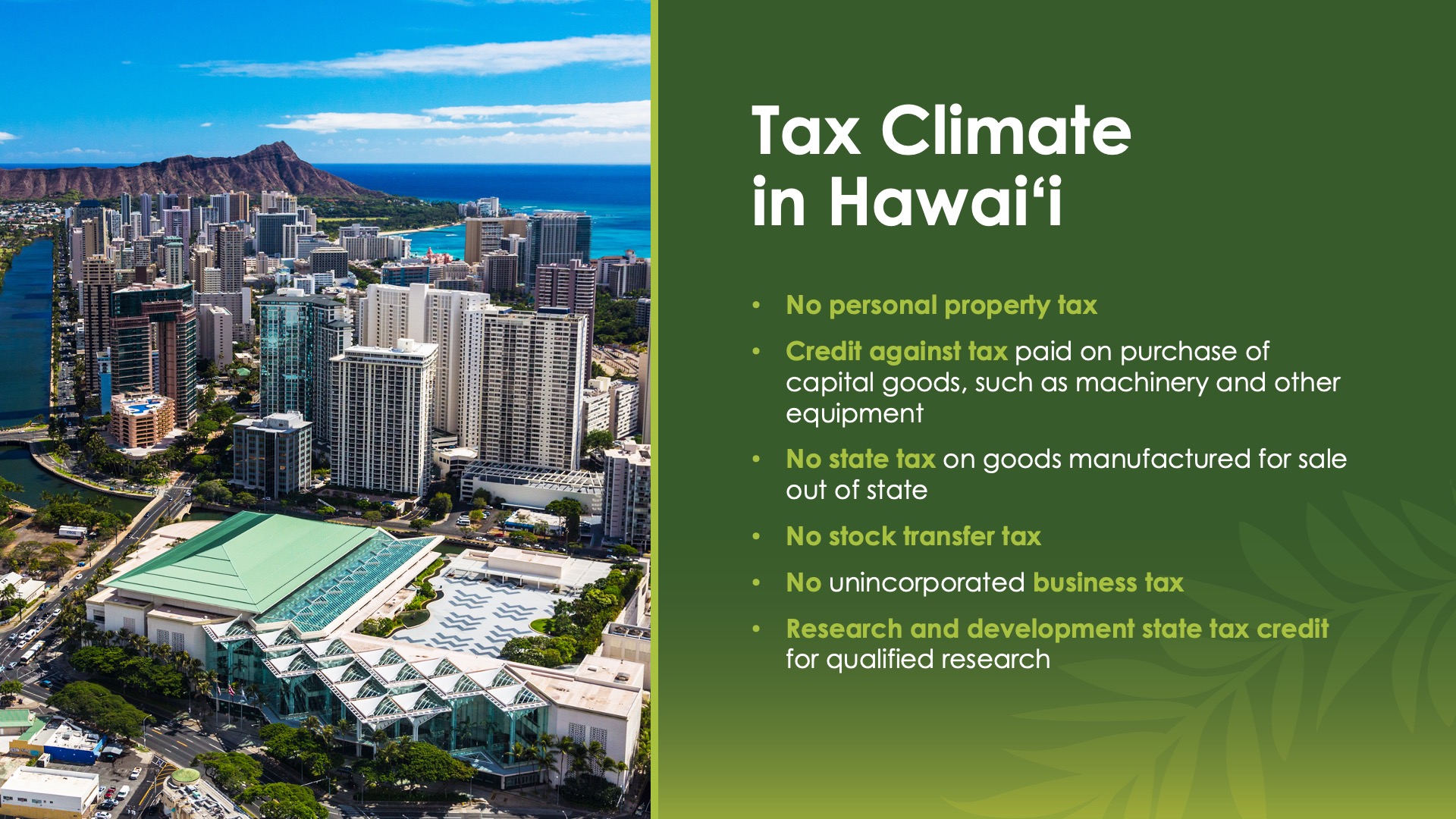

Business Development And Support Division Tax Incentives And Credits

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How Do State And Local Individual Income Taxes Work Tax Policy Center